It takes a few minutes, but the best way to find cheaper prices for car insurance rates is to compare prices at least once a year from different companies in Santa Ana.

It takes a few minutes, but the best way to find cheaper prices for car insurance rates is to compare prices at least once a year from different companies in Santa Ana.

- Get an understanding of policy coverages and the steps you can take to keep rates in check. Many things that increase rates such as at-fault accidents, careless driving, and a lousy credit rating can be remedied by making minor changes to your lifestyle. This article provides more information to help keep rates affordable and find available discounts that you may qualify for.

- Compare price quotes from exclusive agents, independent agents, and direct providers. Exclusive and direct companies can provide rates from a single company like Progressive or Allstate, while independent agencies can quote rates from multiple sources.

- Compare the new rate quotes to the price on your current policy to see if a cheaper rate is available in Santa Ana. If you find a lower rate and buy the policy, ensure coverage does not lapse between policies.

An important note is to compare the same amount of coverage on every quote and and to analyze as many companies as possible. Doing this provides an accurate price comparison and a complete rate analysis.

We don't have to tell you that auto insurance companies want to keep you from shopping around. Insureds who shop around once a year will presumably move their business because there is a high probability of finding a policy with more affordable rates. A study showed that drivers who routinely compared rates saved an average of $3,500 over four years compared to people who never shopped for cheaper rates.

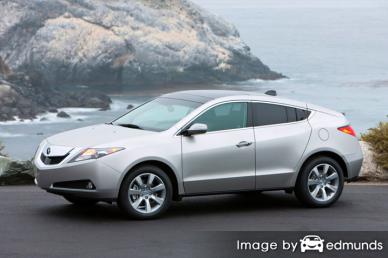

If saving the most money on Acura ZDX insurance in Santa Ana is the reason you're here, then having some insight into the best ways to shop for car insurance can help make the process easier and more efficient.

Cutting your Santa Ana insurance rates can be surprisingly simple. Consumers just need to take the time comparing price quotes to see which company has the cheapest Acura ZDX rate quotes.

It's so fast and easy to compare rates online that it makes it obsolete to drive around to each insurance agency near you. Comparing Acura ZDX insurance rate quotes online makes this process obsolete unless you're the type of person who wants the professional assistance that only an agent can give. If you prefer, some companies allow you to get prices online and still use a local agent.

The companies in the list below offer quotes in Santa Ana, CA. If multiple providers are shown, it's a good idea that you get rate quotes from several of them to get the best price comparison.

Acura ZDX detailed coverage information

The table shown below covers different coverage costs for Acura ZDX models. Having a good grasp of how policy rates are calculated is important to be able to make informed decisions when comparing rates.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $406 | $774 | $416 | $24 | $124 | $1,744 | $145 |

| ZDX AWD | $406 | $774 | $416 | $24 | $124 | $1,744 | $145 |

| ZDX Advance Package AWD | $406 | $874 | $416 | $24 | $124 | $1,844 | $154 |

| Get Your Own Custom Quote Go | |||||||

Price data assumes married female driver age 50, no speeding tickets, no at-fault accidents, $100 deductibles, and California minimum liability limits. Discounts applied include homeowner, claim-free, multi-policy, multi-vehicle, and safe-driver. Premium costs do not factor in vehicle garaging location which can raise or lower coverage rates greatly.

The chart below demonstrates how deductible levels and can increase or decrease Acura ZDX insurance premiums for different age groups. The data assumes a single male driver, comp and collision included, and no discounts are taken into consideration.

Buy Acura ZDX Insurance for Less

When buying auto insurance it's important to understand some of the things that are used to determine the rates you pay for auto insurance. When you understand what determines base rates, this allows you to make educated decisions that can help you get much lower annual insurance costs.

Listed below are some of the most common factors used by your company to calculate premiums.

Physical damage deductibles are a factor - Coverage for physical damage, commonly called comprehensive (or other-than-collision) and collision coverage, covers damage that occurs to your Acura. Examples of covered claims would be a windshield shattered by a rock, damage from fire, and having your car stolen. Physical damage deductibles define the amount you are required to spend out-of-pocket before a claim is paid by your company. The larger the amount you choose to pay out-of-pocket, the lower your rates will be.

Being married is a good thing - Your spouse actually saves money when buying auto insurance. Having a significant other usually means you are less irresponsible it has been statistically shown that married drivers get in fewer accidents.

Insurance companies don't like frequent policy claims - Companies in California provide better rates to people who only file infrequent claims. If you're an insured who likes to file claims you can definitely plan on higher rates. Your car insurance is meant to be used in the event of larger claims.

Rate your vehicle for proper use - The higher the mileage driven in a year's time the higher your rate. The majority of insurers calculate rates based upon how you use the vehicle. Vehicles that sit idle most of the time qualify for better rates than cars that get driven a lot. Having the wrong rating on your ZDX may be costing you higher rates. Ask your agent if your auto insurance policy properly reflects the proper vehicle usage, because improper ratings can cost you money.

Mature drivers are lower risk - Young drivers in California are statistically shown to be inattentive when driving so they pay higher auto insurance rates. Having to add a beginning driver to your policy can break the bank. More experienced drivers are more cautious drivers, cost insurance companies less in claims, and get fewer tickets.

The following chart uses these assumptions: single driver, full coverage with $250 deductibles, and no discounts or violations.

Insurance is not optional

Despite the high insurance cost for a Acura ZDX in Santa Ana, insurance is required for several reasons.

- Almost all states have mandatory liability insurance requirements which means the state requires specific limits of liability in order to get the vehicle licensed. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If you have a loan on your vehicle, most lenders will require that you buy full coverage to ensure loan repayment if the vehicle is totaled. If you let the policy lapse, the bank or lender will purchase a policy for your Acura at a more expensive rate and make you pay the higher premium.

- Insurance protects both your assets and your Acura ZDX. It will also pay for hospital and medical expenses that are the result of an accident. Liability insurance also covers legal expenses if you are named as a defendant in an auto accident. If your car is damaged in a storm or accident, comprehensive and collision coverage will pay to repair the damage.

The benefits of having insurance outweigh the cost, particularly for liability claims. But the average driver in California overpays as much as $820 a year so we recommend shopping around once a year at a minimum to be sure current rates are still competitive.