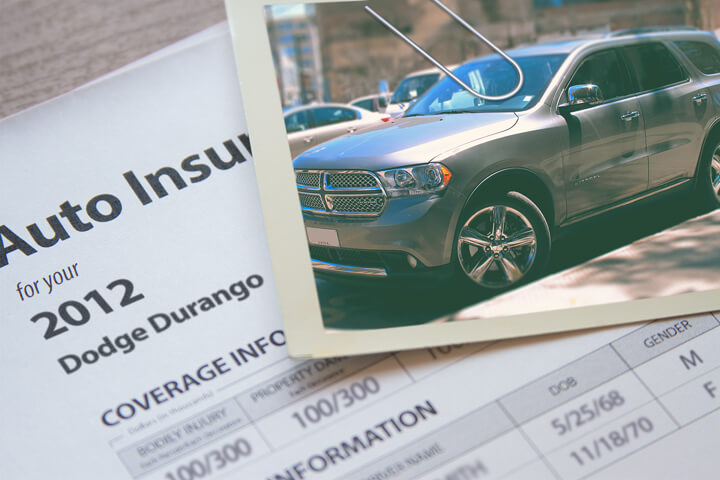

Dodge Durango insurance cost image courtesy of QuoteInspector.com

Searching for cheaper Dodge Durango insurance in Santa Ana? Nobody I know likes having to buy car insurance, in particular when their premiums are through the roof.

Searching for cheaper Dodge Durango insurance in Santa Ana? Nobody I know likes having to buy car insurance, in particular when their premiums are through the roof.

It goes without saying that insurance companies don't want their policyholders to compare prices. Insureds who get price quotes annually are inclined to move their business because the odds are good of finding coverage at a cheaper rate. A recent survey discovered that people who regularly shopped around saved as much as $860 a year as compared to drivers who never shopped for cheaper rates.

If finding budget-friendly Dodge Durango insurance in Santa Ana is the reason for your visit, then having a good understanding the best way to shop and compare insurance can help simplify the task of finding more affordable coverage.

There is such a variety of insurers to insure vehicles with, and though it is a good thing to have a selection, lots of choices makes it harder to compare company pricing for Dodge Durango insurance in Santa Ana.

Most companies allow you to get prices directly from their websites. Doing online quotes for Dodge Durango insurance in Santa Ana is quite simple as all you need to do is type in your personal and coverage information as requested by the quote form. When the form is submitted, the company's rating system automatically orders credit information and your driving record and returns pricing information based on the information you submitted. This makes comparing rates easy, and it's absolutely necessary to perform this step in order to get a better rate.

To quickly fill out one form to compare multiple rates now, consider comparing rates from the companies shown below. If you currently have coverage, we recommend you copy your coverages as close as possible to your current policy. Using the same limits helps guarantee you're receiving an apples-to-apples comparison based on the exact same insurance coverage.

The auto insurance companies shown below can provide comparison quotes in California. If multiple companies are shown, we recommend you visit as many as you can to get a more complete price comparison.

Car insurance is not optional in California

Even though Santa Ana Durango insurance rates can get expensive, insuring your vehicle may not be optional for several reasons.

First, the majority of states have mandatory insurance requirements which means state laws require a specific level of liability protection in order to drive the car. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

Second, if you have a lien on your Durango, most banks will make it a condition of the loan that you buy full coverage to guarantee their interest in the vehicle. If coverage lapses or is canceled, the bank may insure your Dodge at a more expensive rate and force you to pay for the expensive policy.

Third, car insurance preserves both your vehicle and your assets. It will also pay for hospital and medical expenses that are the result of an accident. Liability coverage, the one required by state law, also covers all legal expenses up to the policy limit if anyone sues you for causing an accident. If your car is damaged in a storm or accident, your policy will pay to restore your vehicle to like-new condition.

The benefits of buying car insurance more than offset the price you pay, especially with large liability claims. According to a survey of 1,000 drivers, the average driver overpays more than $830 a year so it's important to compare rates at least once a year to help ensure money is not being wasted.

Car insurance coverage breakdown

Learning about specific coverages of a car insurance policy aids in choosing which coverages you need for your vehicles. The terms used in a policy can be ambiguous and coverage can change by endorsement. Below you'll find typical coverages found on most car insurance policies.

Uninsured Motorist or Underinsured Motorist insurance

Your UM/UIM coverage gives you protection when other motorists either have no liability insurance or not enough. Covered claims include injuries to you and your family as well as your vehicle's damage.

Since many California drivers only purchase the least amount of liability that is required (California limits are 15/30/5), their liability coverage can quickly be exhausted. So UM/UIM coverage should not be overlooked. Frequently these coverages do not exceed the liability coverage limits.

Coverage for liability

This coverage will cover damage that occurs to other people or property by causing an accident. This insurance protects YOU against other people's claims, and doesn't cover your own vehicle damage or injuries.

Coverage consists of three different limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. You commonly see limits of 15/30/5 that translate to $15,000 in coverage for each person's injuries, a total of $30,000 of bodily injury coverage per accident, and $5,000 of coverage for damaged property. Some companies may use a combined single limit or CSL which combines the three limits into one amount and claims can be made without the split limit restrictions.

Liability coverage protects against things such as attorney fees, repair bills for other people's vehicles, legal defense fees, structural damage and loss of income. How much coverage you buy is a personal decision, but consider buying as much as you can afford. California state minimum liability requirements are 15/30/5 but drivers should carry more coverage.

The next chart demonstrates why low liability limits may not be high enough to cover claims.

Collision coverage protection

This coverage pays for damage to your Durango caused by collision with another vehicle or an object, but not an animal. You have to pay a deductible and the rest of the damage will be paid by collision coverage.

Collision can pay for claims such as hitting a mailbox, crashing into a building and crashing into a ditch. Collision is rather expensive coverage, so you might think about dropping it from lower value vehicles. You can also bump up the deductible on your Durango to save money on collision insurance.

Comprehensive coverage (or Other than Collision)

This coverage pays for damage from a wide range of events other than collision. You first must pay your deductible and then insurance will cover the rest of the damage.

Comprehensive can pay for things such as hitting a deer, vandalism, falling objects and rock chips in glass. The most you'll receive from a claim is the ACV or actual cash value, so if it's not worth much more than your deductible consider dropping full coverage.

Insurance for medical payments

Personal Injury Protection (PIP) and medical payments coverage reimburse you for short-term medical expenses for things like surgery, chiropractic care and dental work. The coverages can be used to fill the gap from your health insurance program or if you lack health insurance entirely. It covers both the driver and occupants in addition to getting struck while a pedestrian. Personal Injury Protection is not universally available and gives slightly broader coverage than med pay

Car insurance company ratings

Insuring your vehicle with a good quality insurance company can be difficult considering how many choices drivers have in California. The ranking data shown below could help you select which insurers you want to consider when comparing rate quotes.

Top 10 Santa Ana Car Insurance Companies Overall

- USAA

- American Family

- AAA of Southern California

- State Farm

- The Hartford

- AAA Insurance

- GEICO

- The General

- Titan Insurance

- Progressive

Smart consumers save more

Some companies do not provide internet price quotes and most of the time these small insurance companies prefer to sell through independent agencies. The cheapest Dodge Durango insurance in Santa Ana can be found on the web and also from your neighborhood Santa Ana agents, so you should be comparing quotes from both in order to have the best price selection to choose from.

We covered a lot of information how to find cheap Dodge Durango insurance in Santa Ana. The most important thing to understand is the more quotes you get, the better chance you'll have of finding low cost Santa Ana car insurance quotes. You may even be surprised to find that the most savings is with a company that doesn't do a lot of advertising. Some small companies may often insure only within specific states and give better rates than the large multi-state companies such as State Farm or Progressive.

When shopping online for auto insurance, it's very important that you do not buy less coverage just to save a little money. There are a lot of situations where drivers have reduced collision coverage and found out when filing a claim that the small savings ended up costing them much more. The aim is to find the BEST coverage for the lowest cost while still protecting your assets.

How to find cheaper rates for Dodge Durango insurance in Santa Ana

It takes a little time, but the best way to get budget car insurance rates is to start comparing rates regularly from companies in Santa Ana. This can be done by completing these steps.

- Take a few minutes and learn about the coverage provided by your policy and the modifications you can make to prevent high rates. Many risk factors that result in higher rates like careless driving and a substandard credit score can be improved by making minor changes in your lifestyle.

- Request price quotes from direct, independent, and exclusive agents. Direct companies and exclusive agencies can only quote rates from a single company like GEICO or State Farm, while agents who are independent can provide rate quotes from multiple sources.

- Compare the new rates to your existing policy and determine if there is any savings. If you can save some money, make sure the effective date of the new policy is the same as the expiration date of the old one.

- Tell your current company to cancel the current policy and submit payment and a signed application to the new company. Once the paperwork is finalized, place the new certificate verifying proof of insurance along with the vehicle's registration papers.

A good piece of advice is that you use the same level of coverage on every quote and and to analyze every company you can. This helps ensure an apples-to-apples comparison and and a good selection of different prices.

Additional information

- Auto Insurance FAQ (Farmers Insurance)

- Who Has Affordable Auto Insurance Rates for Safe Drivers in Santa Ana? (FAQ)

- Who Has Cheap Auto Insurance for Drivers Under 25 in Santa Ana? (FAQ)

- Who Has the Cheapest Auto Insurance Quotes for Hybrid Vehicles in Santa Ana? (FAQ)

- Who Has the Cheapest Car Insurance Quotes for Veterans in Santa Ana? (FAQ)

- Smart Auto Insurance Tips (Insurance Information Institute)

- Higher speed limits cause more fatalities (Insurance Institute for Highway Safety)

- Eight Auto Insurance Myths (Insurance Information Institute)

- Red Light Cameras (State Farm)