It's an obvious assumption that insurance companies don't want you to look for a cheaper policy. Consumers who rate shop once a year will probably buy a different policy because they have good chances of finding a lower-priced policy. A study discovered that drivers who compared rates once a year saved over $3,400 over four years compared to policyholders who never shopped around.

It's an obvious assumption that insurance companies don't want you to look for a cheaper policy. Consumers who rate shop once a year will probably buy a different policy because they have good chances of finding a lower-priced policy. A study discovered that drivers who compared rates once a year saved over $3,400 over four years compared to policyholders who never shopped around.

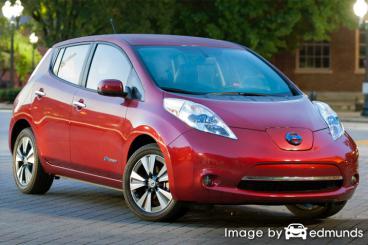

If finding the cheapest rates on Nissan Leaf insurance in Santa Ana is your goal, then having some knowledge of how to get free comparison quotes and analyze auto insurance can help make the process easier.

If saving money is your primary concern, then the best way to get cheaper Nissan Leaf insurance in Santa Ana is to compare quotes annually from insurance carriers who can sell car insurance in California.

- First, read and learn about policy coverages and the measures you can take to drop your rates. Many factors that cause rate increases such as multiple speeding tickets and an unacceptable credit score can be improved by making minor changes in your lifestyle. Keep reading for tips to get cheaper rates and find additional discounts you may qualify for.

- Second, obtain price quotes from direct, independent, and exclusive agents. Direct and exclusive agents can only provide price estimates from one company like Progressive or Farmers Insurance, while independent agents can give you price quotes for many different companies.

- Third, compare the new rate quotes to your current policy to see if a cheaper rate is available in Santa Ana. If you find a lower rate quote and buy the policy, ensure there is no coverage lapse between policies.

One bit of advice is to make sure you're comparing the same physical damage deductibles and liability limits on each price quote and and to get prices from as many different companies as possible. Doing this ensures the most accurate price comparison and a thorough selection of prices.

Finding a lower price on insurance is not a difficult process. Just invest a little time comparing price quotes to find out which insurance company has cheaper Santa Ana auto insurance quotes.

The companies shown below can provide price comparisons in Santa Ana, CA. If several companies are displayed, it's highly recommended you visit as many as you can in order to get a fair rate comparison.

Don't overlook these Nissan Leaf insurance discounts

Companies that sell car insurance don't always list the entire discount list in a way that's easy to find, so we took the time to find a few of the more common and the harder-to-find discounts that you can inquire about if you buy Santa Ana auto insurance online.

- Santa Ana Homeowners Pay Less - Owning your own home or condo can save you money since home ownership shows financial diligence.

- ABS Braking Discount - Cars, trucks, and SUVs that have anti-lock braking systems are safer to drive and will save you 10% or more on Leaf insurance in Santa Ana.

- Telematics Devices - Drivers who elect to allow driving data collection to scrutinize driving patterns by installing a telematics device like Drivewise from Allstate or In-Drive from State Farm might see lower rates as long as they are good drivers.

- College Student Discount - Youth drivers living away from Santa Ana attending college without a vehicle on campus can receive lower rates.

- Safety Course Discount - Taking a course teaching safe driver skills may get you a small discount if you qualify.

Drivers should understand that most discounts do not apply to the entire policy premium. Most only cut the cost of specific coverages such as liability and collision coverage. Just because it seems like you can get free auto insurance, that's just not realistic.

To locate companies with the best Nissan Leaf insurance discounts in Santa Ana in Santa Ana, follow this link.

Why You Might Pay Increased Rates in Santa Ana

Smart consumers have a good feel for some of the factors that come into play when calculating auto insurance rates. If you have some idea of what influences your rates, this allows you to make educated decisions that could result in lower rates.

The itemized list below are some of the most common factors companies use to determine your premiums.

Annual miles impacts prices - The more you drive your Nissan in a year the higher the price you pay to insure it. A lot of companies charge rates based upon how you use the vehicle. Cars and trucks that are left in the garage get more affordable rates than vehicles that are driven to work every day. A policy that improperly rates your Leaf is just wasting money. It's a smart idea to ensure your auto insurance declarations sheet properly reflects the correct usage for each vehicle, because improper ratings can cost you money.

Lower rates with alarm systems - Owning a car with a theft deterrent system can help bring down rates. Theft deterrent systems like vehicle immobilizer systems, OnStar, and tracking devices like LoJack can help prevent car theft.

Auto insurance lapses raise auto insurance rates - Not having insurance is against the law and you will pay a penalty because you let your insurance lapse. Not only will you pay more, the inability to provide proof of insurance might get you a hefty fine and possibly a revoked license. Then you may be required to file a SR-22 with the California DMV.

Do you qualify for a multi-policy discount? - The majority of insurers will award discounts to people who buy several policies from them, otherwise known as a multi-policy discount. If you currently are using one company, it's in your best interest to shop around to verify if the discount is saving money. You may still be able to find lower rates by buying insurance from more than one company.

Cautious drivers pay lower premiums - Drivers with clean records get better rates than bad drivers. Only having one chargeable violation can bump up the cost by as much as twenty percent. Drivers who have flagrant violations such as reckless driving, hit and run or driving under the influence might be required by their state to complete a SR-22 with their state DMV in order to continue driving.

Employer stress can make you pay more - Did you know your auto insurance rates can be affected by your occupation? Occupational choices like real estate brokers, air traffic controllers, and stock brokers generally have higher rates than average because of intense work requirements and extremely grueling work hours. On the other hand, jobs like professors, engineers and performers generally pay rates lower than average.

Prices impacted by your city - Choosing to live in less populated areas of the country is a positive aspect when it comes to auto insurance. Fewer people means a lower chance of having an accident as well as less vandalism and auto theft. Urban drivers regularly have traffic congestion and more severe claims. More time behind the wheel means more chance of being in an accident.

Insurance loss probability for a Nissan Leaf - Auto insurance companies take into consideration historical loss data for every vehicle to help determine the rate you pay. Vehicles that have higher loss trends will have higher rates for specific coverages.

The next table shows the historical loss data for Nissan Leaf vehicles. For each policy coverage type, the claim probability for all vehicles, regardless of manufacturer or model, is represented as 100. Numbers that are below 100 imply a favorable loss record, while percentages above 100 show a trend for more claims or statistically larger claims.

| Make and Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Nissan Leaf Electric | 89 | 84 | 45 | 83 | 64 | 76 |

Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years