Unbelievable but true according to a study nearly 70% of drivers have been with the same company for four years or more, and virtually 40% of consumers have never compared rates to find cheaper insurance. With the average auto insurance premium being $1,390, Santa Ana drivers could save $500 a year by just shopping around, but they just don't understand how easy it is to do a rate comparison.

Really, the only way to get affordable car insurance rates in Santa Ana is to compare quotes once a year from insurance carriers that insure vehicles in California.

Really, the only way to get affordable car insurance rates in Santa Ana is to compare quotes once a year from insurance carriers that insure vehicles in California.

- Step 1: Try to comprehend policy coverages and the measures you can take to prevent high rates. Many rating factors that result in higher prices like traffic tickets, fender benders, and a not-so-good credit history can be controlled by improving your driving habits or financial responsibility.

- Step 2: Request price quotes from direct, independent, and exclusive agents. Direct companies and exclusive agencies can only quote rates from a single company like GEICO and Allstate, while independent agencies can give you price quotes from multiple companies. View a list of agents

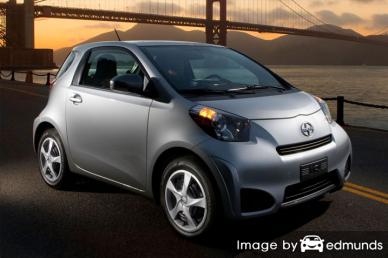

- Step 3: Compare the new rates to your existing rates and determine if cheaper iQ coverage is available in Santa Ana. If you find better rates, verify that coverage does not lapse between policies.

- Step 4: Tell your current agent or company to cancel your current car insurance policy and submit the signed application along with the required initial payment to the new insurer. Once the paperwork is finalized, put the certificate verifying coverage in an accessible location in your vehicle.

A good tip to remember is to compare similar limits and deductibles on every price quote and and to get prices from as many companies as possible. Doing this enables the most accurate price comparison and maximum price selection.

The quickest method to get rate comparisons for Scion iQ insurance in Santa Ana is to take advantage of the fact auto insurance companies actually pay money for the chance to provide you with free rate quotes. The only thing you need to do is provide the companies a bit of rating information including if a SR-22 is required, if it has an alarm system, whether you drive to work or school, and driver details. Your insurance information gets transmitted to multiple companies and you will receive price estimates very quickly.

To get price quotes for your Scion iQ now, click here and find out if lower rates are available in Santa Ana.

The companies shown below offer free rate quotes in California. If the list has multiple companies, we recommend you compare several of them in order to get a fair rate comparison.

Insurance agencies can find coverage gaps

Some consumers still prefer to buy from a local agent and doing that can be a smart decision Professional agents can help you build your policy and will help you if you have claims. The best thing about comparing rate quotes online is that you can obtain lower rates but still work with a licensed agent. And providing support for local insurance agents is still important in Santa Ana.

After completing this form (opens in new window), your insurance data is emailed to companies in Santa Ana who will gladly provide quotes to get your business. It makes it easy because there is no need to contact any insurance agencies since price quotes are sent immediately to you. If you have a need to quote rates from one company in particular, you can always jump over to their website and complete a quote there.

After completing this form (opens in new window), your insurance data is emailed to companies in Santa Ana who will gladly provide quotes to get your business. It makes it easy because there is no need to contact any insurance agencies since price quotes are sent immediately to you. If you have a need to quote rates from one company in particular, you can always jump over to their website and complete a quote there.

If you want a reliable insurance agent, you should know the types of agencies and how they function. Agencies in Santa Ana are either exclusive agents or independent agents. Either one can sell affordable auto insurance policies, but it's worth learning the difference in how they write coverage since it could factor into the kind of agent you use.

Independent Auto Insurance Agents

These type of agents can sell policies from many different companies and that allows them to write policies through many different auto insurance companies and possibly get better coverage at lower prices. If you want to switch companies, an independent agent can move your coverage and that require little work on your part. If you are comparing auto insurance prices, we recommend you include at a minimum one independent agency to have the most options to choose from.

Below is a small list of independent insurance agents in Santa Ana that may be able to give you rate quotes.

Sureguard Insurance Agency Inc

555 Park Center Dr #118 - Santa Ana, CA 92705 - (714) 464-8010 - View Map

Neighborhood Insurance Agency

1333 E First St - Santa Ana, CA 92701 - (714) 285-9990 - View Map

Mural Insurance Agency

1202 17th St #103 - Santa Ana, CA 92701 - (714) 541-1003 - View Map

Exclusive Agents

Exclusive insurance agents can usually just insure with one company such as AAA, State Farm, Farmers Insurance, and Allstate. These agents are unable to provide prices from multiple companies so always compare other rates. Exclusive insurance agents are trained well on sales techniques which helps offset the inability to provide other markets.

Below is a short list of exclusive agents in Santa Ana that can give you rate quotes.

Farmers Insurance Agency: Blake Robbins

3611 S Harbor Blvd #200 - Santa Ana, CA 92704 - (417) 263-1934 - View Map

Farmers Insurance - Araceli Padilla

2424 N Grand Ave b - Santa Ana, CA 92705 - (714) 543-4638 - View Map

Monica Drevon - State Farm Insurance Agent

3740 S Bristol St - Santa Ana, CA 92704 - (714) 966-2679 - View Map

Choosing an insurance agent requires more thought than just a cheap price quote. These are some valid questions you should ask.

- What insurance companies do they recommend if they are an independent agent?

- Will high miles depreciate repair valuations?

- How many years of experience in personal auto insurance do they have?

- Does the agency provide any after hours assistance?

- Are they able to influence company decisions when a claim is filed?

- Do they make recommendations based only on price?

- Is the agent CPCU or CIC certified?

Best car insurance company in Santa Ana

Insuring your vehicle with the right car insurance company can be challenging considering how many companies sell coverage in California. The information shown next can help you pick which insurers you want to consider purchasing coverage from.

Top 10 Santa Ana Car Insurance Companies Ranked by Claims Service

- AAA of Southern California

- State Farm

- Esurance

- AAA Insurance

- Progressive

- Liberty Mutual

- GEICO

- Allstate

- Titan Insurance

- The Hartford

Top 10 Santa Ana Car Insurance Companies by A.M. Best Rank

- USAA - A++

- Travelers - A++

- State Farm - A++

- GEICO - A++

- Esurance - A+

- Nationwide - A+

- Allstate - A+

- Mercury Insurance - A+

- Progressive - A+

- Titan Insurance - A+