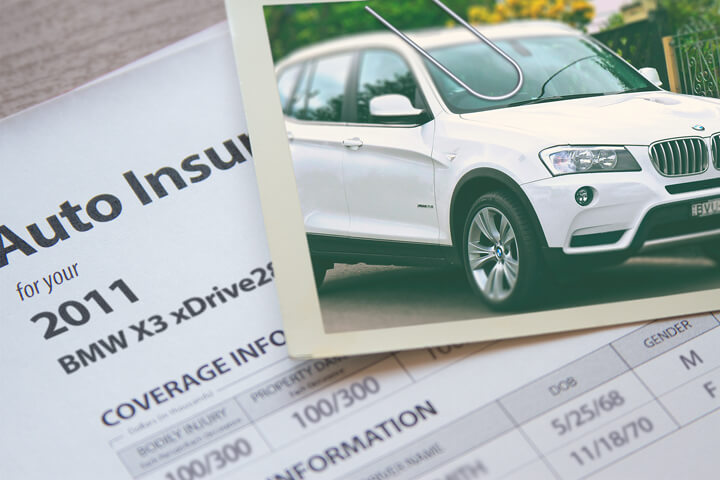

BMW X3 insurance cost image courtesy of QuoteInspector.com

Shockingly, most insurance customers kept buying from the same company for over three years, and 38% of drivers have never shopped around. Drivers in California can save hundreds of dollars each year, but they don't know the actual amount they would save if they swap their current policy for a cheaper one.

Shockingly, most insurance customers kept buying from the same company for over three years, and 38% of drivers have never shopped around. Drivers in California can save hundreds of dollars each year, but they don't know the actual amount they would save if they swap their current policy for a cheaper one.

The best way to get discount BMW X3 insurance is to do an annual price comparison from companies in Santa Ana. Drivers can shop around by following these steps.

First, read about how insurance works and the measures you can take to keep rates in check. Many things that cause high rates such as at-fault accidents and a negative credit score can be improved by improving your driving habits or financial responsibility.

Second, compare price quotes from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can only give rate quotes from one company like GEICO or State Farm, while independent agents can provide rate quotes for a wide range of insurance providers.

Third, compare the new quotes to the premium of your current policy to see if cheaper X3 coverage is available. If you find a lower rate quote and change companies, verify that coverage does not lapse between policies.

One key aspect when comparing rates is to try to compare similar deductibles and liability limits on each quote request and and to get price estimates from as many companies as you can. Doing this enables a fair rate comparison and the best price selection.

Best BMW X3 insurance prices in California

The auto insurance companies shown below provide free quotes in Santa Ana, CA. If multiple providers are shown, it's highly recommended you click on several of them to get a more complete price comparison.

Statistics and details

The coverage information below covers a range of insurance rates for BMW X3 models. Being aware of how insurance premiums are calculated can help customers make smart choices when comparing insurance quotes.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| X3 3.0I xDrive AWD 4-Dr | $388 | $774 | $596 | $36 | $178 | $1,972 | $164 |

| Get Your Own Custom Quote Go | |||||||

Table data assumes single female driver age 30, no speeding tickets, no at-fault accidents, $500 deductibles, and California minimum liability limits. Discounts applied include multi-policy, claim-free, safe-driver, multi-vehicle, and homeowner. Information does not factor in vehicle location which can alter prices noticeably.

Policy deductibles

When comparing insurance rates, the most common question is which comprehensive and collision deductibles to buy. The rates shown below may aid in understanding the cost difference when you buy lower versus higher insurance deductibles. The first set of rates uses a $250 physical damage coverage deductible and the second set of rates uses a $1,000 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| X3 3.0I xDrive AWD 4-Dr | $430 | $780 | $442 | $26 | $132 | $1,835 | $153 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| X3 3.0I xDrive AWD 4-Dr | $266 | $490 | $442 | $26 | $132 | $1,356 | $113 |

| Get Your Own Custom Quote Go | |||||||

Cost estimates assume married male driver age 30, no speeding tickets, no at-fault accidents, and California minimum liability limits. Discounts applied include multi-vehicle, safe-driver, claim-free, homeowner, and multi-policy. Rate quotes do not factor in Santa Ana location which can raise or lower coverage prices greatly.

Based on the data above, we can derive that using a $250 deductible will cost you about $40 more each month or $480 annually than requesting the higher $1,000 deductible. Since you would pay $750 more if you turn in a claim with a $1,000 deductible as compared to a $250 deductible, if you go at least 19 months between claims, you would probably come out ahead going with the higher deductible. Here is how you can decide this on your own policy.

| Average monthly premium for $250 deductibles: | $153 |

| Average monthly premium for $1,000 deductibles (subtract): | - $113 |

| Monthly savings from raising deductible: | $40 |

| Difference between deductibles ($1,000 - $250): | $750 |

| Divide difference by monthly savings: | $750 / $40 |

| Number of months required between physical damage coverage claims in order to save money by choosing the higher deductible | 19 months |

One thing to note is that raising deductibles means you will have to pay more of your own money when you have a physical damage claim. That will require some money saved in the event you have to pay the higher deductible.

Rate difference between full and liability-only coverage

The diagram below shows the comparison of BMW X3 car insurance costs with full coverage compared to only the California minimum liability coverage. The premiums are based on a clean driving record, no claims, $100 deductibles, drivers are not married, and no other discounts are factored in.

When to stop buying physical damage coverage

There is no definitive guideline to stop buying physical damage coverage, but there is a general guideline you can use. If the yearly cost of comp and collision coverage is more than 10% of replacement cost minus your deductible, then you might want to think about dropping full coverage.

For example, let's pretend your BMW X3 book value is $5,000 and you have $1,000 deductibles. If your vehicle is totaled, the most you would get paid by your company is $4,000 after the deductible is paid. If you are paying over $400 a year for your policy with full coverage, then it's probably a good time to buy liability coverage only.

There are some scenarios where dropping full coverage is not advised. If you haven't satisfied your loan, you have to maintain full coverage in order to satisfy the requirements of the loan. Also, if you can't afford to buy a different vehicle if your current one is damaged, you should keep full coverage.

Cheaper Santa Ana insurance quotes with discounts

Insuring your vehicles can cost a lot, but there's a good chance there are discounts that many consumers don't even know exist. A few discounts will be applied at the time of purchase, but a few must be specifically requested before you will receive the discount.

- Student Discount for Driver Training - Have your child participate in a local driver's education class in school or through a local driver safety program.

- Driving Data Discount - Drivers that enable companies to analyze when and where they use their vehicle by using a telematics device in their vehicle such as Drivewise from Allstate or Snapshot from Progressive might get better premium rates if their driving habits are good.

- Fewer Miles Equal More Savings - Fewer annual miles on your BMW could be rewarded with slightly better insurance rates than normal.

- Discounts for Federal Employees - Simply working for the federal government could provide a small rate reduction depending on your company.

- Multi-line Discount - Not all insurance companies offer life insurance, but some may give you a small discount if you purchase a life policy as well.

- Early Renewal Discounts - Select larger companies give a discount for switching companies before your current coverage expires. You can save around 10% with this discount.

Discounts save money, but please remember that many deductions do not apply to your bottom line cost. Most cut the price of certain insurance coverages like comp or med pay. Even though it may seem like adding up those discounts means a free policy, it doesn't quite work that way. Any qualifying discounts should definitely cut the amount you have to pay.

The example below shows the comparison of BMW X3 auto insurance costs with and without discounts. The prices are based on a male driver, no violations or accidents, California state minimum liability limits, full physical damage coverage, and $100 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with claim-free, safe-driver, multi-car, homeowner, marriage, and multi-policy discounts applied.

Car insurance companies that possibly offer most of the discounts above possibly include:

Before you buy a policy, ask all the companies which discounts can lower your rates. Some credits may not be offered in your state.

What Affects BMW X3 Insurance Costs?

Lots of factors are part of the calculation when quoting car insurance. A few of the factors are predictable such as your driving history, although some other factors are not quite as obvious like where you live or your commute time. The best way to find cheaper insurance is to take a look at some of the factors that come into play when calculating your insurance rates. If you know what impacts premium levels, this allows you to make educated decisions that may result in cheaper rates.

Better drivers have lower rates - Your driving record influences premium rates substantially. Drivers with clean records have lower premiums as compared to those with violations. Having just one chargeable violation may increase your cost by twenty percent. Drivers who have multiple violations like DWI, reckless driving or hit and run convictions may find they need to submit a SR-22 form to the state department of motor vehicles in order to prevent a license revocation.

The illustration below shows how traffic citations and at-fault accidents can impact BMW X3 annual premium costs for each age group. The price estimates are based on a single female driver, full coverage, $500 deductibles, and no discounts are applied.

Reduce premiums by driving cars with good safety ratings - Vehicles with good safety scores cost less to insure. Safer cars reduce occupant injuries and fewer serious injuries means lower claim amounts and thus lower rates. If your BMW X3 has at least four stars on Safercar.gov it may be receiving lower rates.

Rural areas have lower prices - Being located in less populated areas of the country is a good thing when insuring your vehicles. Residents of big cities have congested traffic and more severe claims. Lower population translates into fewer accident claims.

The type of car you drive affects your rates - The make and model of the vehicle you are trying to find cheaper insurance for makes a big difference in your rates. Small economy passenger vehicles normally have pretty low rates, but many other things help determine your insurance rates.

The chart below assumes a married male driver age 40, full coverage with $500 deductibles, and no discounts or violations. The chart compares BMW X3 car insurance rates compared to other models that have different performances.

Occupation and insurance prices - Did you know your career choice can influence rates? Careers like fire fighters, architects, and accountants have higher average rates due to high stress and long work hours. Conversely, occupations such as actors, historians and the unemployed pay the least.

Infrequent drivers can save - The more you drive your BMW in a year's time the more you will pay for insurance. Almost all companies price each vehicle's coverage based upon how much you drive. Cars and trucks used primarily for pleasure use receive lower rates as compared to vehicles used primarily for driving to work. An improperly rated X3 may be costing you higher rates. Verify your declarations sheet shows the correct usage, because improper ratings can cost you money.

Insurance losses for a BMW X3 - Insurance companies use claims history to calculate a rate that will offset losses. Models that the data determines to have higher number or severity of losses will have higher rates for specific coverages.

The table below demonstrates the actual insurance loss data for BMW X3 vehicles. For each insurance policy coverage type, the claim amount for all vehicles, regardless of make, model or trim level, equals 100. Percentages below 100 suggest a better than average loss history, while values over 100 point to more losses or tendency to have larger claims.

| Vehicle Make and Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| BMW X3 4dr 2WD | 122 | 99 | ||||

| BMW X3 4dr 4WD | 109 | 93 | 117 | 69 | 64 | 76 |

Empty fields indicate not enough data collected

Data Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

You may want advice from an insurance agent

Many drivers just want to buy from a licensed agent. A nice benefit of getting online price quotes is you can get cheap rate quotes but still work with a licensed agent.

To make it easy to find an agent, after completing this quick form, your coverage information is emailed to agents in your area who will give you quotes for your auto insurance coverage. There is no reason to visit any agencies since rate quotes are delivered directly to your email. You can get cheaper auto insurance rates and a licensed agent to work with. If you have a need to compare prices from a specific insurance company, don't hesitate to jump over to their website and fill out the quote form the provide.

To make it easy to find an agent, after completing this quick form, your coverage information is emailed to agents in your area who will give you quotes for your auto insurance coverage. There is no reason to visit any agencies since rate quotes are delivered directly to your email. You can get cheaper auto insurance rates and a licensed agent to work with. If you have a need to compare prices from a specific insurance company, don't hesitate to jump over to their website and fill out the quote form the provide.

Finding the right company shouldn't rely on just the bottom line cost. Below are some questions you should ask.

- Do you need full coverage on every vehicle?

- How long have they been in business?

- If they are an independent agency in Santa Ana, which companies do they recommend?

- Will the agent help in case of a claim?

- What is the agency's Better Business Bureau rating?

If you are wanting to find an insurance agent, it's important to understand the types of insurance agents that you can select. Auto insurance policy providers may be either independent (non-exclusive) or exclusive.

Exclusive Insurance Agencies

Agents of this type can only provide pricing for a single company and some examples include State Farm, AAA, Farmers Insurance or Allstate. Exclusive agents are unable to compare other company's rates so if the price isn't competitive there isn't much they can do. Exclusive agents receive extensive training on the products they sell and that allows them to sell at a higher price point.

Below are exclusive insurance agents in Santa Ana willing to provide price quotes.

Farmers Insurance - Maria Guerrero

1647 E First St a - Santa Ana, CA 92701 - (714) 285-0303 - View Map

Farmers Insurance - Daniel Canzone

2323 N Tustin Ave, Ste E-F - Santa Ana, CA 92705 - (714) 203-6033 - View Map

Farmers Insurance: Sandy Hocking-Cline

1801 Park Ct Pl - Santa Ana, CA 92701 - (714) 973-9100 - View Map

Independent Agents

Agents in the independent channel can quote rates with many companies so they can quote policies with a variety of different insurance companies and get you the best rates possible. If you want to switch companies, an independent agent can move your coverage and you can keep the same agent. If you need cheaper auto insurance rates, it's recommended you get some free quotes from several independent agencies in order to have the best price comparison.

The following is a list of independent insurance agencies in Santa Ana who can help you get comparison quotes.

SureCo Insurance Agency

201 Sandpointe Ave Suite 600 - Santa Ana, CA 92707 - (866) 845-9815 - View Map

Quality Plus Insurance Agency

1450 N Tustin Ave # 221 - Santa Ana, CA 92705 - (714) 245-1200 - View Map

Mary Juarez Insurance

1227 W 1st St c - Santa Ana, CA 92703 - (714) 542-5914 - View Map

Persistent drivers can save

Cheaper insurance in Santa Ana can be bought on the web and also from your neighborhood Santa Ana agents, so you need to quote Santa Ana auto insurance with both to have the best rate selection. Some insurance companies do not offer rate quotes online and most of the time these regional carriers sell through independent agencies.

In this article, we presented some good ideas how you can save on BMW X3 insurance in Santa Ana. The key concept to understand is the more quotes you get, the higher the chance of saving money. You may even be surprised to find that the best price on insurance is with some of the lesser-known companies. These companies can often insure niche markets at a lower cost than the large multi-state companies such as State Farm, GEICO and Nationwide.

More learning opportunities

- Teen Driving and Texting (State Farm)

- Who Has Cheap Car Insurance Rates for Drivers Over Age 60 in Santa Ana? (FAQ)

- Five Tips to Save on Auto Insurance (Insurance Information Institute)

- Think You're a Safe Driver? (State Farm)

- How to shop for a safer car (Insurance Institute for Highway Safety)