If you want to save money, the best way to find cheaper quotes for car insurance rates in Santa Ana is to do a yearly price comparison from insurers who can sell car insurance in California. This can be done by following these guidelines.

If you want to save money, the best way to find cheaper quotes for car insurance rates in Santa Ana is to do a yearly price comparison from insurers who can sell car insurance in California. This can be done by following these guidelines.

- Step 1: Try to learn a little about car insurance and the measures you can control to prevent rate increases. Many risk factors that cause rate increases such as traffic citations and a substandard credit score can be remedied by making lifestyle changes or driving safer. Continue reading for ideas to get low prices and find additional discounts you may qualify for.

- Step 2: Quote rates from direct, independent, and exclusive agents. Direct companies and exclusive agencies can provide rates from one company like GEICO or State Farm, while independent agencies can quote prices for many different companies. Find a Santa Ana insurance agent

- Step 3: Compare the new rates to your current policy and determine if cheaper Dakota coverage is available in Santa Ana. If you find a better price and decide to switch, make sure coverage does not lapse between policies.

- Step 4: Notify your agent or company to cancel the current policy. Submit a signed application and payment for your new policy. When you receive it, place the new certificate verifying proof of insurance in your vehicle.

A good piece of advice is to compare identical limits and deductibles on each quote request and and to get prices from every company you can. Doing this helps ensure an apples-to-apples comparison and the best rate selection.

It's astonishing, but the vast majority of drivers renewed their policy with the same company for more than four years, and virtually 40% of consumers have never compared rates with other companies. With the average insurance premium being $1,400, California drivers could save roughly 35% each year, but they mistakenly think it's difficult to shop around.

If you already have coverage or need a new policy, you will benefit by learning to shop for the lowest rates while maintaining coverages. Quoting and comparing the cheapest auto insurance coverage in Santa Ana is not as hard as you think. Drivers only have to learn the most efficient way to compare rate quotes from many different companies online.

The quickest method we recommend to compare insurance rates in your area is to know all the major auto insurance companies provide online access to compare rate quotes. To get started, all you need to do is provide details including how old drivers are, how you use your vehicles, if the car is leased, and if you went to college. Your rating data is submitted instantly to all major companies and they return cost estimate within a short period of time.

To start a quote now, click here and find out if you can get cheaper insurance in Santa Ana.

The companies shown below can provide price comparisons in California. If multiple companies are shown, it's highly recommended you get price quotes from several of them in order to get a fair rate comparison.

Coverage statistics and figures

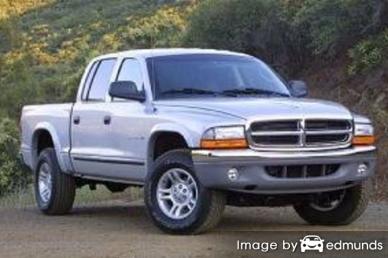

The data table below showcases estimates of coverage costs for Dodge Dakota models. Being more informed about how insurance prices are calculated is important for making informed decisions when comparing rates.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Dakota ST Ext Cab 2WD | $208 | $454 | $580 | $34 | $174 | $1,450 | $121 |

| Dakota Bighorn Ext Cab 2WD | $208 | $454 | $580 | $34 | $174 | $1,450 | $121 |

| Dakota Lonestar Ext Cab 2WD | $238 | $454 | $580 | $34 | $174 | $1,480 | $123 |

| Dakota ST Crew Cab 2WD | $238 | $454 | $580 | $34 | $174 | $1,480 | $123 |

| Dakota Bighorn Crew Cab 2WD | $238 | $536 | $580 | $34 | $174 | $1,562 | $130 |

| Dakota Lonestar Crew Cab 2WD | $238 | $536 | $580 | $34 | $174 | $1,562 | $130 |

| Dakota Bighorn Ext Cab 4WD | $270 | $454 | $464 | $28 | $138 | $1,354 | $113 |

| Dakota ST Ext Cab 4WD | $270 | $454 | $464 | $28 | $138 | $1,354 | $113 |

| Dakota Laramie Crew Cab 2WD | $270 | $536 | $580 | $34 | $174 | $1,594 | $133 |

| Dakota ST Crew Cab 4WD | $270 | $454 | $464 | $28 | $138 | $1,354 | $113 |

| Dakota Lonestar Ext Cab 4WD | $270 | $454 | $464 | $28 | $138 | $1,354 | $113 |

| Dakota Bighorn Crew Cab 4WD | $270 | $454 | $464 | $28 | $138 | $1,354 | $113 |

| Dakota TRX Crew Cab 4WD | $270 | $536 | $464 | $28 | $138 | $1,436 | $120 |

| Dakota TRX Crew Cab 4WD | $270 | $536 | $464 | $28 | $138 | $1,436 | $120 |

| Dakota Lonestar Crew Cab 4WD | $270 | $536 | $464 | $28 | $138 | $1,436 | $120 |

| Dakota Laramie Crew Cab 4WD | $300 | $536 | $464 | $28 | $138 | $1,466 | $122 |

| Get Your Own Custom Quote Go | |||||||

Table data assumes married female driver age 40, no speeding tickets, no at-fault accidents, $500 deductibles, and California minimum liability limits. Discounts applied include homeowner, multi-vehicle, safe-driver, claim-free, and multi-policy. Price information does not factor in zip code location which can influence insurance rates greatly.

How careless driving impacts insurance rates

The diagram below shows how violations and at-fault collisions raise Dodge Dakota insurance prices for each different age group. The data is based on a married male driver, comp and collision included, $1,000 deductibles, and no policy discounts are applied.

Insurance rates based on gender in Santa Ana

The chart below shows the difference between Dodge Dakota auto insurance costs for male and female drivers. The prices are based on no tickets, no at-fault accidents, comprehensive and collision coverage, $100 deductibles, marital status is single, and no discounts are applied.

Insurance protects more than just your car

Despite the high insurance cost for a Dodge Dakota in Santa Ana, paying for insurance is required for several reasons.

- The majority of states have mandatory insurance requirements which means you are required to carry specific limits of liability insurance coverage in order to drive the car legally. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If your vehicle has a lienholder, most lenders will force you to buy insurance to ensure they get paid if you total the vehicle. If you do not keep the policy in force, the bank may buy a policy for your Dodge at an extremely high rate and require you to fork over for the expensive policy.

- Insurance preserves your vehicle and your assets. It will also provide coverage for hospital and medical expenses for you, your passengers, and anyone else injured in an accident. Liability coverage, the one required by state law, also covers legal expenses in the event you are sued. If you have damage to your Dodge as the result of the weather or an accident, comprehensive and/or collision insurance will pay to repair the damage.

The benefits of insuring your car greatly outweigh the cost, particularly for liability claims. According to a recent study, the average American driver is overpaying over $865 each year so it's very important to do a rate comparison once a year at a minimum to ensure rates are inline.

You may qualify for discounts for Dodge Dakota insurance in Santa Ana

Insuring your fleet can be pricey, but you might be missing out on some discounts to cut the cost considerably. Some discounts apply automatically when you get a quote, but lesser-known reductions have to be manually applied before you get the savings.

- Payment Method - By paying your entire bill at once as opposed to paying monthly you can avoid monthly service charges.

- Distant Student - Youth drivers who live away from home at college and leave their car at home could get you a discount.

- Theft Deterrent - Cars optioned with advanced anti-theft systems help deter theft and therefore earn up to a 10% discount.

- Use Seat Belts - Drivers who require all occupants to fasten their seat belts can save up to 10 percent (depending on the company) on the medical payments or PIP coverage costs.

- Organization Discounts - Affiliation with a civic or occupational organization in Santa Ana could earn you a nice discount when getting a Santa Ana car insurance quote.

A little disclaimer on discounts, some of the credits will not apply to your bottom line cost. Most cut specific coverage prices like comprehensive or collision. Even though it may seem like adding up those discounts means a free policy, nobody gets a free ride. But any discount will definitely reduce your car insurance premiums.

The chart below shows the difference between Dodge Dakota insurance premiums with and without discounts applied to the policy rates. The data assumes a female driver, no tickets, no at-fault accidents, California state minimum liability limits, full physical damage coverage, and $250 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with claim-free, marriage, multi-policy, multi-car, homeowner, and safe-driver discounts applied.

Companies and some of the premium reductions they offer are detailed below.

- Progressive includes discounts for multi-policy, continuous coverage, online quote discount, online signing, and homeowner.

- GEICO offers discounts for driver training, anti-theft, multi-policy, federal employee, and membership and employees.

- State Farm offers premium reductions for Steer Clear safe driver discount, anti-theft, multiple autos, safe vehicle, passive restraint, and Drive Safe & Save.

- Esurance has discounts for defensive driver, safety device, multi-car, anti-lock brakes, DriveSense, and emergency road assistance.

- The Hartford may offer discounts for defensive driver, good student, driver training, vehicle fuel type, and bundle.

When comparing rates, check with every prospective company which discounts you may be entitled to. All car insurance discounts may not be available in Santa Ana. If you would like to see a list of providers with discount car insurance rates in Santa Ana, click this link.

Insurance agent or online?

A lot of people just prefer to buy from a local agent and we recommend doing that Agents will help you protect your assets and give you someone to call. One of the great benefits of getting online price quotes is the fact that you can find cheap car insurance rates and still buy from a local agent. And supporting small agencies is important particularly in Santa Ana.

Once you complete this simple form, the quote information is emailed to companies in Santa Ana who want to provide quotes and help you find cheaper coverage. You won't even need to do any legwork because prices are sent directly to your email. If you have a need to get a rate quote from a particular provider, you would need to go to their quote page and fill out the quote form the provide.

Once you complete this simple form, the quote information is emailed to companies in Santa Ana who want to provide quotes and help you find cheaper coverage. You won't even need to do any legwork because prices are sent directly to your email. If you have a need to get a rate quote from a particular provider, you would need to go to their quote page and fill out the quote form the provide.

If you need to find a reputable insurance agent or broker, there are a couple of different agency structures and how they differ in how they can insure your vehicles. Car insurance agencies can either be independent or exclusive depending on the company they work for. Both types of agents can write policy coverage, but we need to point out the difference in the companies they write for because it can factor into which agent you choose.

Independent Agents

Independent agents are not limited to a single company and that gives them the ability to insure through many companies depending on which coverage is best. If they quote lower rates, your agent can switch companies which makes it simple for you.

When comparing rates, you absolutely need to include price quotes from a few independent agents to have the best price comparison. Many write coverage with companies you've never heard of that may have much lower rates than larger companies.

Featured below is a list of independent agencies in Santa Ana who can help you get free price quotes.

- SureCo Insurance Agency

201 Sandpointe Ave Suite 600 - Santa Ana, CA 92707 - (866) 845-9815 - View Map - Roberti's Insurance Agency

2128 N Tustin Ave #B - Santa Ana, CA 92705 - (714) 543-2788 - View Map - Barrett Insurance Agency

1438 S Main St - Santa Ana, CA 92707 - (714) 973-9999 - View Map

Exclusive Car Insurance Agencies

Agents of this type write business for a single company and some examples include Farmers Insurance, Allstate, or State Farm. These agents are unable to compare other company's rates so they have to upsell other benefits. Exclusive agents receive extensive training on their company's products which helps them compete with independent agents. Some consumers prefer to buy from exclusive agents primarily because of high brand loyalty rather than low price.

Listed below are exclusive agencies in Santa Ana that can give you comparison quotes.

- Farmers Insurance - Eduardo Machado

1701 N Main St Ste 180 - Santa Ana, CA 92706 - (714) 352-0700 - View Map - Farmers Insurance - Daniel Canzone

2323 N Tustin Ave, Ste E-F - Santa Ana, CA 92705 - (714) 203-6033 - View Map - Farmers Insurance Agency: Blake Robbins

3611 S Harbor Blvd #200 - Santa Ana, CA 92704 - (417) 263-1934 - View Map

Picking the best auto insurance agent should depend on more than just the price. A good agent in Santa Ana will have answers to these questions.

- If they are an independent agency in Santa Ana, which companies do they recommend?

- Is the agent and/or agency licensed to do business in California?

- Did they already check your driving record and credit reports?

- Are they able to provide referrals?

- Will the company cover a rental car if your car is getting fixed?

- Are there any extra charges for paying monthly?

- Can glass claims be handled at your home?

- Does the agency have a current Errors and Omissions policy?

Learn about insurance coverages for a Dodge Dakota

Having a good grasp of insurance can be of help when determining the best coverages and the correct deductibles and limits. The terms used in a policy can be impossible to understand and even agents have difficulty translating policy wording.

Collision - Collision coverage pays to fix your vehicle from damage resulting from colliding with another vehicle or an object, but not an animal. You have to pay a deductible and the rest of the damage will be paid by collision coverage.

Collision coverage pays for things like sustaining damage from a pot hole, scraping a guard rail and driving through your garage door. Collision is rather expensive coverage, so analyze the benefit of dropping coverage from vehicles that are 8 years or older. You can also increase the deductible on your Dakota to get cheaper collision coverage.

Liability coverages - Liability coverage provides protection from damages or injuries you inflict on other people or property in an accident. Split limit liability has three limits of coverage: bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. Your policy might show limits of 15/30/5 which means $15,000 bodily injury coverage, a per accident bodily injury limit of $30,000, and $5,000 of coverage for damaged property. Alternatively, you may have one number which is a combined single limit which limits claims to one amount with no separate limits for injury or property damage.

Liability insurance covers claims such as emergency aid, repair bills for other people's vehicles, attorney fees, legal defense fees and bail bonds. How much coverage you buy is a personal decision, but buy as large an amount as possible. California requires minimum liability limits of 15/30/5 but it's recommended drivers buy better liability coverage.

The next chart shows why buying low liability limits may not provide you with enough coverage.

Medical payments coverage and PIP - Med pay and PIP coverage kick in for expenses for things like funeral costs, surgery, prosthetic devices, pain medications and X-ray expenses. They are utilized in addition to your health insurance policy or if you lack health insurance entirely. Coverage applies to all vehicle occupants in addition to any family member struck as a pedestrian. Personal injury protection coverage is only offered in select states and may carry a deductible

Comprehensive coverage - Comprehensive insurance coverage will pay to fix damage from a wide range of events other than collision. A deductible will apply and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive coverage pays for claims such as hitting a bird, a tree branch falling on your vehicle, hitting a deer, fire damage and rock chips in glass. The maximum amount you'll receive from a claim is the ACV or actual cash value, so if your deductible is as high as the vehicle's value it's probably time to drop comprehensive insurance.

Uninsured/Underinsured Motorist coverage - Uninsured or Underinsured Motorist coverage protects you and your vehicle when the "other guys" are uninsured or don't have enough coverage. This coverage pays for hospital bills for your injuries as well as damage to your Dodge Dakota.

Due to the fact that many California drivers have only the minimum liability required by law (15/30/5 in California), their liability coverage can quickly be exhausted. That's why carrying high Uninsured/Underinsured Motorist coverage is a good idea. Normally your uninsured/underinsured motorist coverages do not exceed the liability coverage limits.

Don't give up on affordable rates

Discount Dodge Dakota insurance in Santa Ana can be sourced from both online companies and with local Santa Ana insurance agents, and you need to price shop both in order to have the best price selection to choose from. Some insurance providers may not offer online rate quotes and most of the time these small insurance companies sell through local independent agents.

Drivers change insurance companies for a variety of reasons including poor customer service, lack of trust in their agent, high rates after DUI convictions and extreme rates for teen drivers. Regardless of your reason, finding a new car insurance company is less work than it seems.

In this article, we covered a lot of information how to save on Dodge Dakota insurance in Santa Ana. The most important thing to understand is the more times you quote, the better chance you'll have of finding affordable Santa Ana car insurance quotes. You may even discover the lowest rates come from the smaller companies.

More detailed car insurance information can be found in the articles below:

- Senior Drivers (Insurance Information Institute)

- Who Has the Cheapest Auto Insurance Quotes for Electric Cars in Santa Ana? (FAQ)

- Credit and Insurance Scores (Insurance Information Institute)

- Vehicle Size and Weight FAQ (iihs.org)